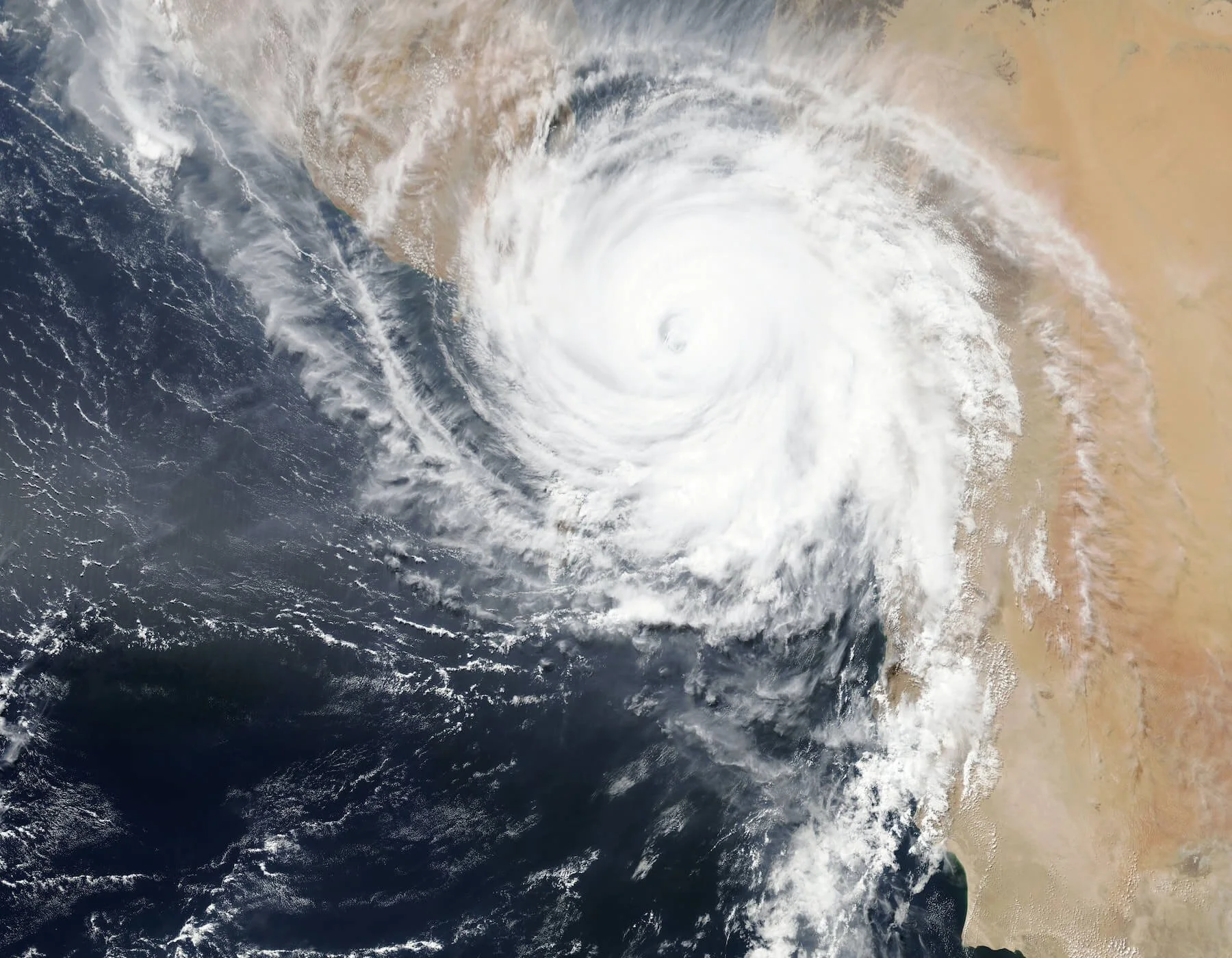

SBA Disaster Assistance Available for Businesses Impacted by Hurricane Ian

If you or your small business experienced impact from Hurricane Ian, you may be eligible for SBA assistance.

Renters and Homeowners may seek disaster relief.

Renters are eligible for up to $40,000 in relief to cover items including clothing, cars, electronics, and other residential items

Homeowners are eligible for up to $200,000 in relief for damage to their primary residence and you may be eligible to refinance your mortgage

Small businesses are eligible for up to $2 Million in disaster relief loans at low interest rates with amortization schedules of up to 30 years.

Relief loans can cover real estate, furniture, electronics, equipment, sidewalks, windows/doors, inventory, etc.

No waiting for insurance to process your claim

Businesses of any size are eligible

Economic Injury Disaster Loans (EIDL) are available as working capital loans to help small businesses with ongoing operating expenses.

EIDL may cover rent, payroll, utilities, etc.

This would be a separate loan from the above disaster relief loan

Business owners can learn more about eligibility and the application process via the SBA Disaster Assistance website and you can view the SBA Fact Sheet for Disaster Loans. The fastest way to proceed through the process is to have your latest tax return paperwork at the ready. Approved funds will generally be released on a rolling basis as they are approved.